https://dl.acm.org/doi/abs/10.1145/3543106.3543114

ABSTRACT

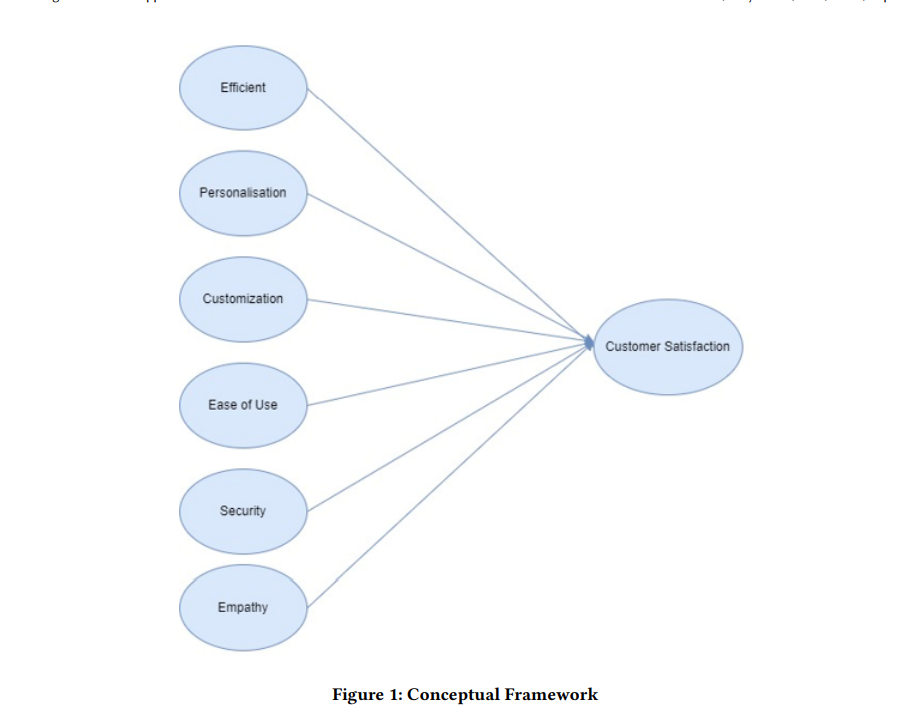

The all-round deep integration of artificial intelligence and finance, with applications such as intelligent customer acquisition, big data risk control, intelligent customer service and financial cloud gradually gaining popularity, indicates that China has entered the era of intelligent finance. This paper firstly explains the theoretical basis of customer satisfaction, the relevant definitions and characteristics of intelligent finance, and proposes the factors of influence of intelligent finance on customer satisfaction of commercial banks. Secondly, by extensively reading and collating customer satisfaction-related literature, and combining the relevant characteristics of smart finance and the actual situation of Guangxi branch of J Bank of China, a customer satisfaction model was constructed. Once again, relevant data were collected by setting up questionnaires and conducting surveys, and SPSS software was used to carry out empirical analysis. The conclusion is that the efficiency, personalisation, customisation, ease of use, security and empathy of smart finance all have a certain influence on customer satisfaction, with efficiency, personalisation, customisation and ease of use having a higher degree of influence and security and empathy having a relatively smaller degree of influence. Finally, through the findings of the study, specific suggestions are made to improve customer satisfaction at J Bank of China Guangxi Branch with regard to different smart financial influencing factors.